Is this the end? The price of Bitcoin and other cryptocurrencies are falling and China has issued a ban on them

After Elon Musk, China also hit the nail in Bitcoins on’s coffin, the price of which began to fall into a fantastic free fall as a result.

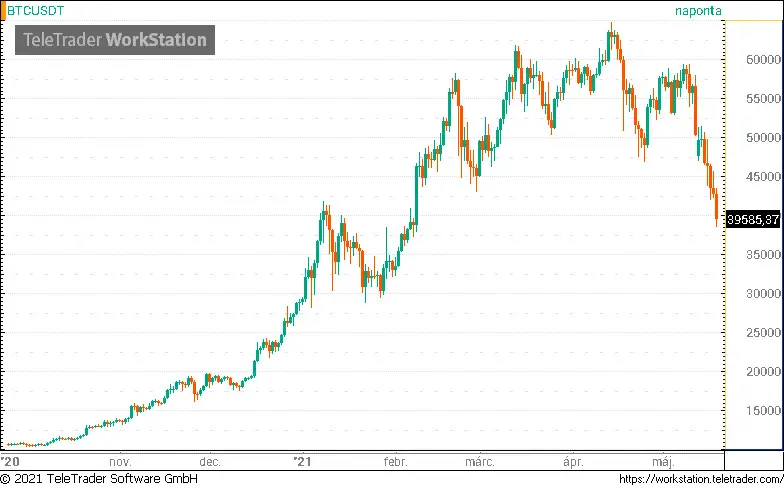

Anyone who actively follows the events of the crypto world could have noticed quite impressive turns. With more minor breaks but steadily rising exchange rates since November 2020, have embarked on a fantastic free fall, becoming “worthless” by $700 billion in just the last few days, and that’s far from over.

The first blow came from Elon Musk, who announced that he no longer wanted to invest in Bitcoin and cryptocurrencies based on similar mining systematics. Moreover, contrary to his earlier statements, Tesla did not accept bitcoin as a means of payment.

The reason was that the tech mogul – after the stock market drift – realized that cryptocurrency mining has little effect on the environment.

Of course, enlightenment could have come earlier, for example, before constructing many Chinese mining parks. In any case, Musk’s sentences were followed by a rather steep fall, which now seemed to subside. Still,

China has now properly ignited, causing it to continue its historic free fall – dragging down virtually the entire crypt market.

Chinese financial officials have announced a ban on all trading and registration of cryptocurrencies throughout the country.

On Tuesday, three Chinese industry groups overseeing the financial sector announced in a joint statement that banking and payment institutions would no longer be allowed to engage in the cryptocurrency business, specifically banning various cryptocurrency registration, trading, clearing, and settlement. Forbes.

This was entirely explained because cryptocurrencies and digital tokens have no real value, and prices are also straightforward to manipulate.

As a result of the announcement, the price of bitcoins fell by 8%, which means a 21% drop for the week and a 40% drop compared to the previous peak. Bitcoin is now under $ 40,000 – at the time of writing. It stands at $ 37,000.

In addition to stablecoin, all of this harmed almost all cryptocurrencies: Ethereum fell 12%, BNB 25%, but even Cardano’s ADA token fell 12% in a single day.

All this supports the Chinese position. It is an excellent example of how and to what extent an announcement can affect exchange rates, favoring speculators such as Elon Musk, Jack Dorsey, Square, or MicroStrategy, are not a few. Money has previously been invested in the cryptocurrencies involved.

In 2017, we could already see a similar wave of the regulation (though it didn’t have that much of an echo yet), which brought an 80% correction. It is not yet known whether this will also be a correction period or the end of the former “bull market,” but it is certainly not very good to keep our savings in cryptocurrency now.